$1.8B Fine in Insider Trading Case

04 Nov, 2013

Hedge fund giant SAC Capital Advisors has agreed to plead guilty to fraud charges and to pay a $1.8 billion financial penalty, federal prosecutors said Monday.

The government said in a letter to judges presiding over the Manhattan case that it believed the financial penalty is the largest in history for insider trading offenses.

The company will pay a $900 million fine and forfeit another $900 million to the federal government. It also will terminate its investment advisory business.

The government called the penalties “steep but fair” and “commensurate with the breadth and duration of the charged criminal conduct.”

The deal follows a separate agreement by SAC to pay a $615 million penalty to settle an insider trading claim by the Securities and Exchange Commission.

A spokesman for SAC Capital did not immediately return messages for comment.

Criminal charges including wire and securities fraud were filed in July against the Stamford, Conn.-based SAC Capital, which is owned by billionaire Steven A. Cohen. They accused the company of making hundreds of millions of dollars illegally.

A prosecutor said at the time that evidence against the company was “voluminous” and included electronic messages, instant messages, court-ordered wiretaps and consensual recordings. Prosecutors said a work culture at SAC permitted, if not encouraged, insider trading.

Authorities alleged that SAC Capital earned hundreds of millions of dollars illegally from 1999 to 2010 as its portfolio managers and analysts traded on inside information from at least 20 public companies. Bharara in July said SAC Capital “trafficked in inside information on a scale without any known precedent in the history of hedge funds.”

Of the roughly $15 billion in assets that SAC managed as of earlier this year, about half belonged to Cohen and his employees. The rest was client money.

Cohen wasn’t named as a defendant in the case. He was repeatedly referenced in court papers at the “SAC owner” who “enabled and promoted” insider trading practices.

AP

Mentioned In This Post:

About the author

Related Posts

-

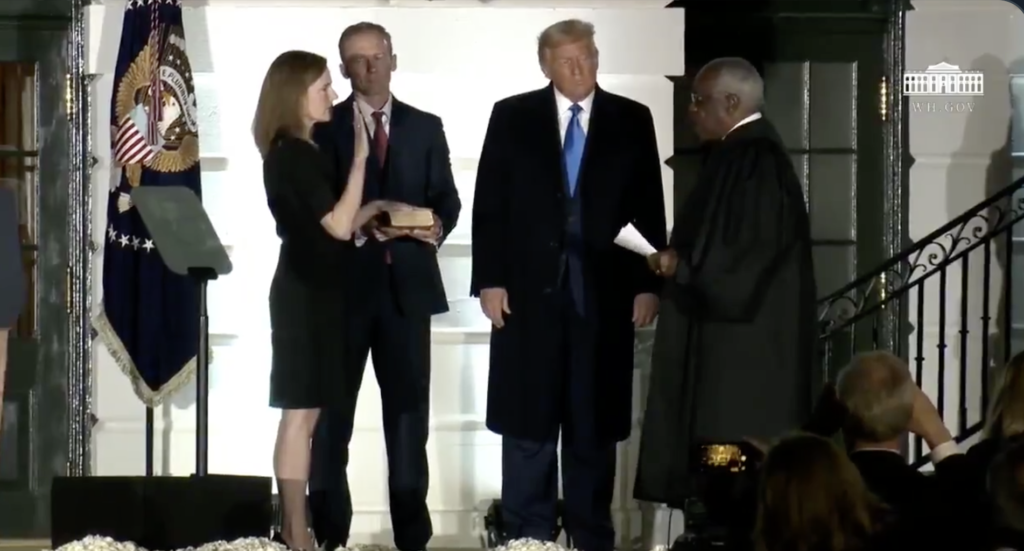

Like it or Not, Amy's In.

-

Rest In Peace RBG

-

MOST Amazing Graduation Gift Ever!

-

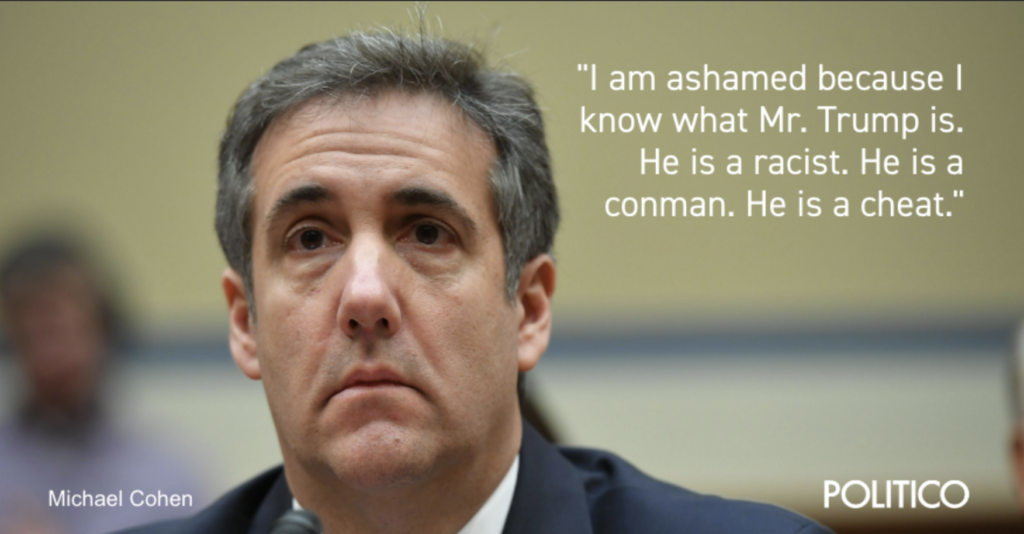

Trump is "A Racist, Con Man & A Cheat!"

-

Trump's Not Gonna Like This

-

Welcome To The Forbes List Mrs. Bezos

-

Cohen Has Turned On Trump Already

-

Wow! Trump's Own Lawyer Secretly Taped Him

-

Trump's Supreme Court Pick Is In

-

Sounds Like Somebody Cut A Deal