Nike’s New LeBron to Sell for $300

21 Aug, 2012

Nike Inc. (NKE) is raising the prices of its sneakers, assuming that the brand’s cachet will carry it through a period when many of its shoppers are scrounging for discounts.

As labor, materials and shipping costs increase, Nike is raising shoe and clothing prices by 5% to 10%, analysts say. A test of the approach comes this fall, when Nike will debut its priciest sneaker yet—an expected $315 LeBron James basketball shoe that includes its own electronics.

The price leaps come after Nike’s gross margins dropped to 42.8% from 44.3% in its most recent quarter ending May 31, the sixth-straight year-to-year quarterly decline. Nike’s margins are now lower than most of its direct competitors, rival Adidas AG and apparel maker Under Armour Inc.

The price increases, from a company whose trendy footwear sometimes generates long lines of avid buyers, may test even the most dedicated Nike fans.

“Prices are getting crazy excessive and as long as we continue to buy sneakers, Nike is going to keep increasing the prices,” said Donell Brown, 30, who owns a cleaning services company in Dearborn, Mich.

Mr. Brown said he and his friends have been posting messages on Twitter and YouTube, urging other longtime sneaker fans not to buy the pricier LeBron shoes and to forgo waiting in line for new sneaker releases.

Nike’s price increases are also being felt at the lower end: The venerable Converse Chuck Taylor All-Star sneaker now costs $50 compared with $45 a year ago.

Nike isn’t the only sneaker maker asking customers to pay more. Adidas’s signature three-striped Superstar shoes now cost $70, nearly 8% more than a year ago. Overall basketball shoe prices were up 9.4% compared with a year before as of June, according to market researcher NPD Group Inc., while soccer cleats jumped 15.5% and running shoes climbed 5.5%.

Nike’s basketball and soccer shoes make up about half its North American business, according to analysts.

Some families are already noting sticker shock as they start back-to-school shopping.

“Sneaker prices have definitely shot up this year,” said Lucy Rangel, 37 years old, who was shopping for sneakers with her two teenage daughters at a Foot Locker store in Dallas.

Ms. Rangel said she paid $114 for a new pair of pink and purple Nike sneakers for her 12-year-old daughter, up from $69.99 she paid last year for a similar pair.

While many retailers try to attract budget-conscious consumers by touting price cuts, analysts say shoppers are willing to spend more on products with newer technology and fresher styles. Footwear companies are strategically testing price increases, typically raising them only when they come out with updated products.

Nike is known for some pricey shoes, going back to its first pair of Air Jordans. A new version of the Air Jordan is expected in December at $185, up from its original 1985 price of $64.99 (or $138.38 in today’s dollars), a 33% increase when adjusted for inflation.

Nike is “not arbitrarily taking up prices,” said spokeswoman Mary Remuzzi. “We are constantly looking at ways to enhance the product line with new innovation and product attributes.”

The coming $315 LeBron X Nike Plus, due in the fall, is expected to come embedded with motion sensors that can measure how high players jump. The LeBron 9 PS Elite basketball shoes, which currently retail for $250, feature Nike’s signature swoosh in metallic gold.

Nike, based in Beaverton, Ore., says it is passing along price increases because many of key materials, such as cotton, have risen in price over the past 18 months. Prices did moderate somewhat in the past quarter.

Nike also faces rising labor costs in China, where it manufactures a third of its products.

The company’s shares, which have soared since the recession as it continued to report solid growth, plunged 10% in June after it reported profit dropped nearly 8% from a year earlier to $549 million, or $1.17 a share. Shares closed at $95.77 on Monday and are now flat for the year after hitting an all-time high of $114.81 on May 3.

Adidas is struggling with similar pressures: It said last month it is closing its only company-owned apparel factory in China to “improve efficiency.” Adidas’s increased labor and materials costs drove gross profit margins down to 48.2% from 49.2%.

“We are trying to mitigate the costs by manufacturing our products more efficiently,” said Katja Schreiber, an Adidas spokeswoman. “In some instances we look to increase price, usually in areas where we launch new, innovative products.”

As reported by the Wall Street Journal

Mentioned In This Post:

About the author

Related Posts

-

Coward Waffle House Killer is Arrested

-

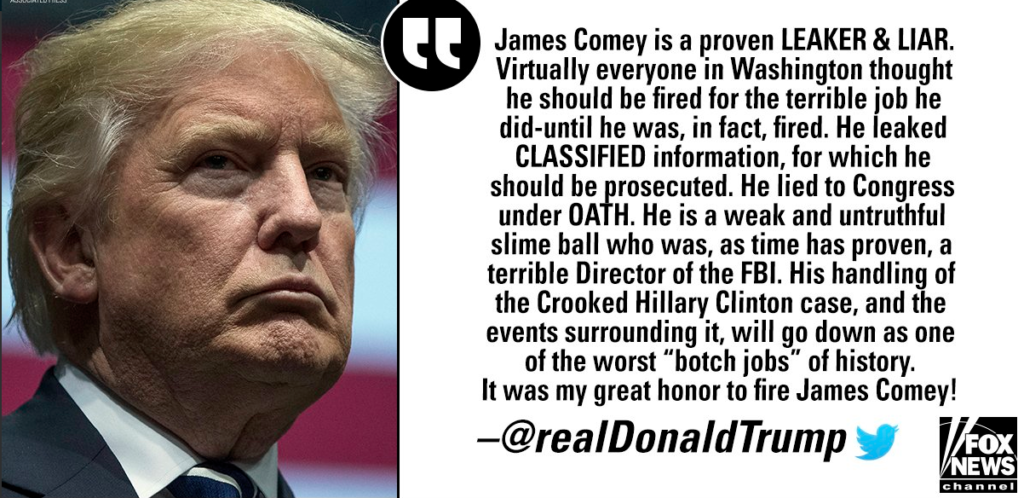

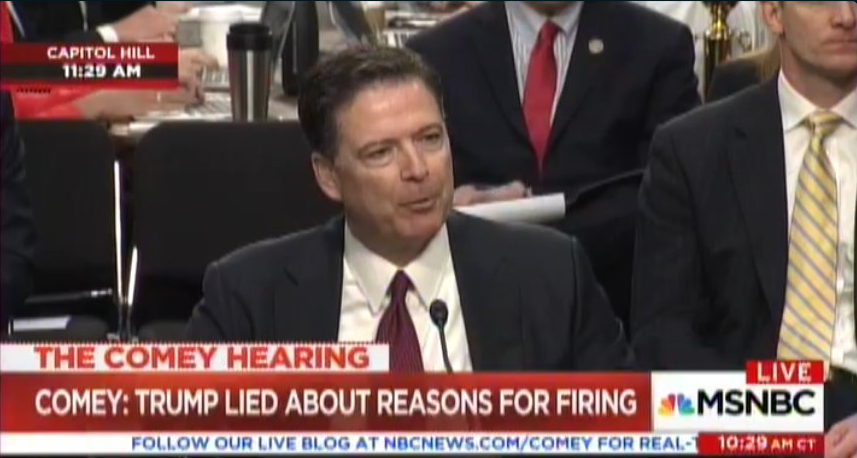

Trump Is NOT Gonna Like These #ComeyMemos

-

"Morally Unfit To Be President."

-

James Comey's Book Is Coming Out And Trump is Loosing It

-

And The FBI Deputy Director is Out

-

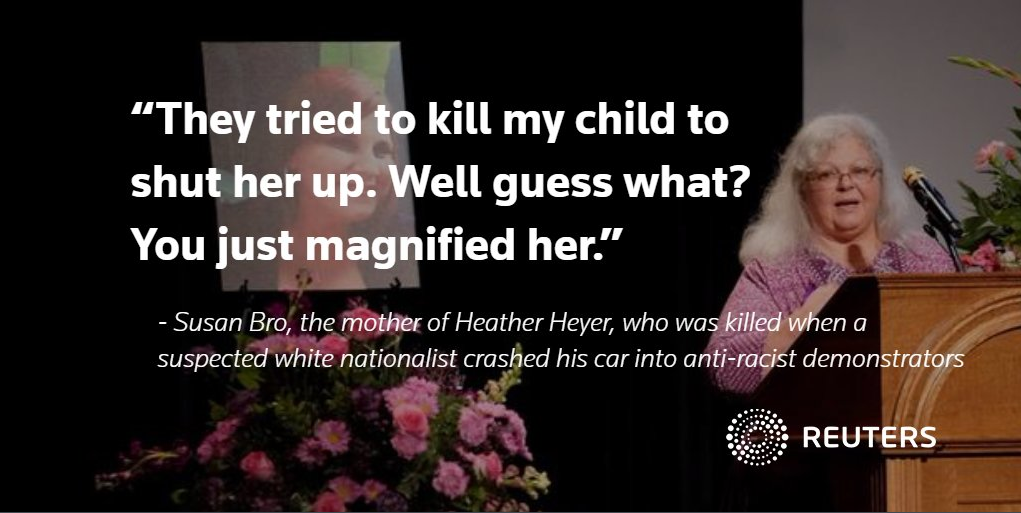

Heather Heyer Remembered at Memorial Service

-

White Supremacy Terrorist Rams Car Into Protest Killing One

-

Jeff Sessions Was Not Happy About Testifying Today

-

Was #ComeyDay A Bad Day For Trump?

-

It's Comey Day. Shits About To Get Interesting