Now There is One True King of Beers

13 Oct, 2015

Beer brewers Anheuser-Busch InBev and SABMillersaid Tuesday they have agreed “in principle” on the terms of the Belgian-headquartered firm’s offer for the British-South African company.

The offer, AB InBev’s fourth, values SABMiller at $104 billion.

For over a month, Budweiser maker AB InBev had been trying to acquire SABMiller, its main competitor in the brewing market. But Its previous offers were met with resistance.

Tuesday’s agreement is tentative, although SABMiller said its board was prepared to recommend it. The companies have until Oct. 28. to reach a formal agreement under British mergers-and-acquisition legislation.

But a final agreement, if reached, would likely prompt intense anti-trust reviews in both the U.S. and the European Union.

SABMiller’s London-listed shares soared nearly 9% following the announcement. AB InBev’s shares rose 4.2% in Brussels.

AB InBev will pay 44 pounds (about $68) share in cash for a majority of SABMiller’s shares. That price is 50% higher than the closing value of SABMiller’s stock on Sept. 14, the day before it first emerged that a bid would take place.

Bloomberg reported that if the deal goes through the combined companies would be responsible for one out of every three beers sold worldwide.

The new company would be headquartered in Belgium.

USA Today

Image CNN twitter

Mentioned In This Post:

About the author

Related Posts

-

Anti-Lockdown Protests Are A Thing Now

-

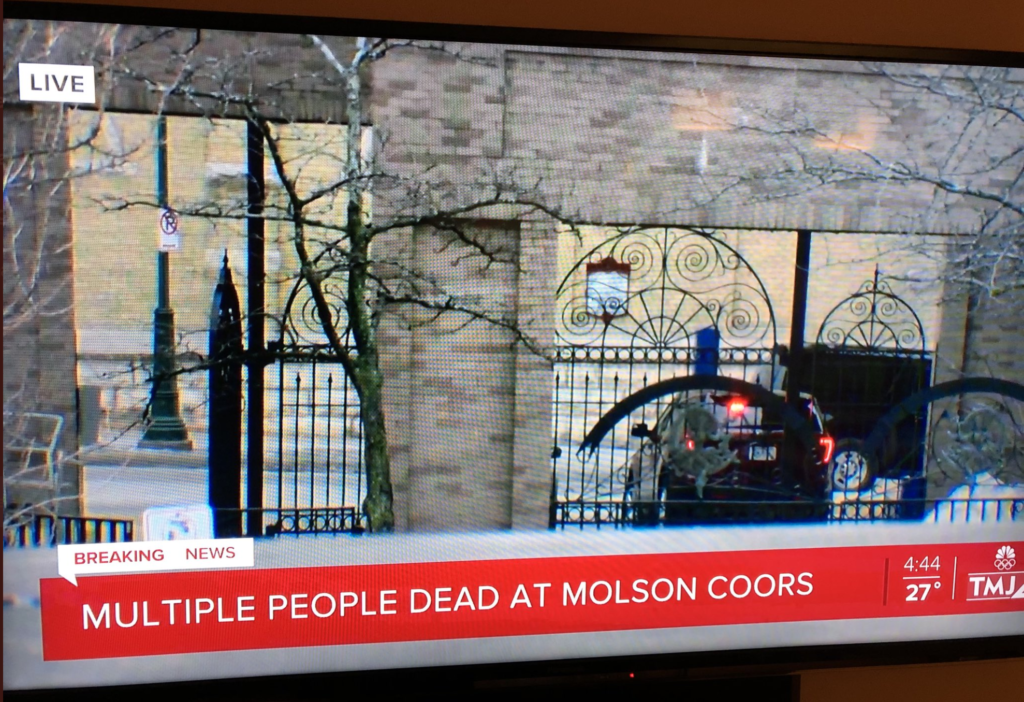

Coward With A Gun Kills 5 at Work

-

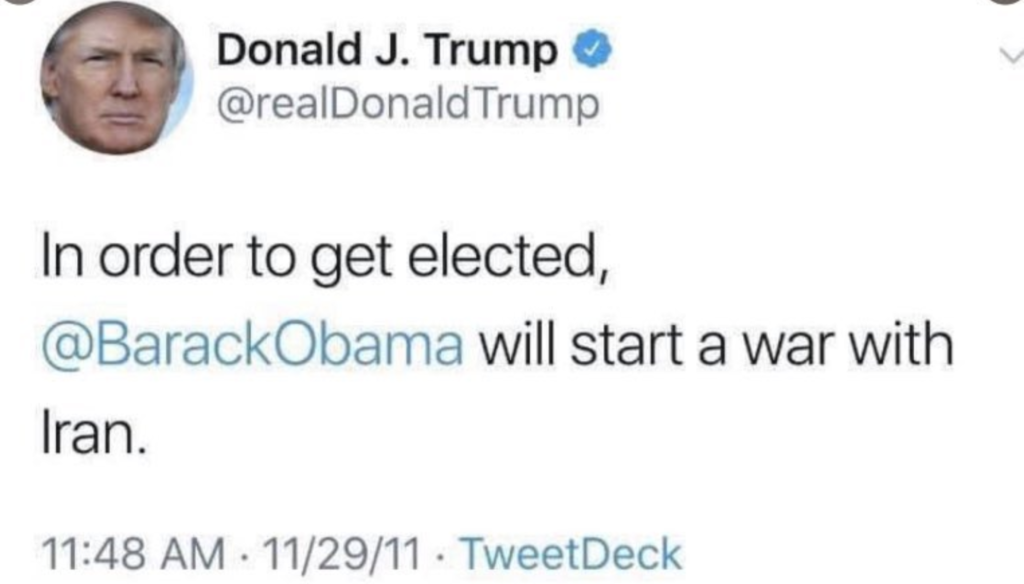

Get Ready For WWIII

-

The Impeachment is On!

-

There's a New Hero in Town to Fight Against Bullying

-

Murdered By Police, in Her Own Home

-

That's It, I'm Outta Here

-

The Clap Hear Around the Internet

-

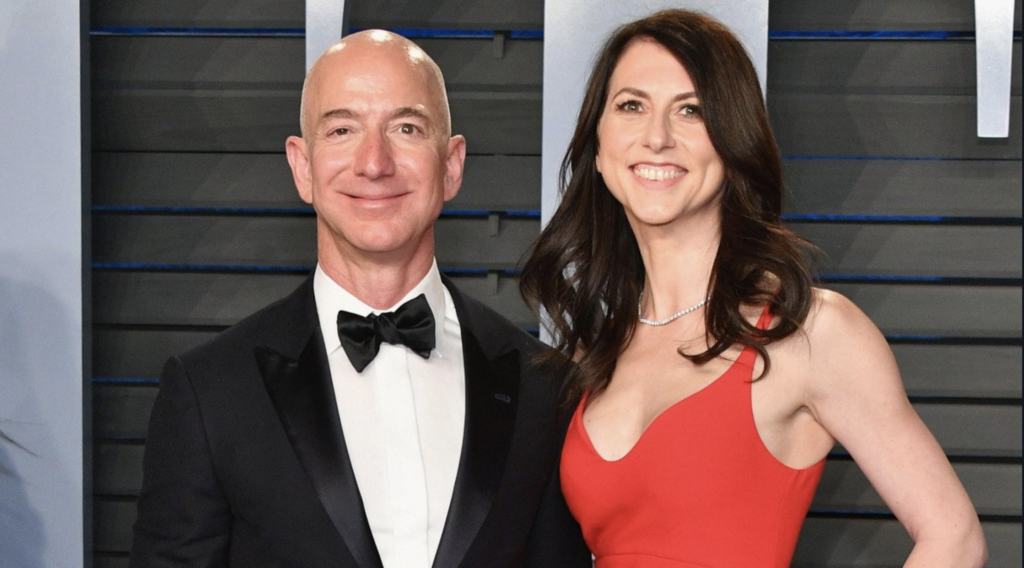

Welcome To The Forbes List Mrs. Bezos

-

Terrorist Coward Kills 3 At Christmas Market