What Can $48.5B Buy you….DirecTV

18 May, 2014

AT&T plans to pay $48.5 billion to buy DirecTV, the top U.S. satellite TV operator, in a bid for growth beyond an increasingly competitive cellular market.

The deal, announced on Sunday, comes as Comcast Corp awaits regulatory approval of its $45 billion bid for Time Warner Cable Inc, a transaction that has the potential to transform the television landscape by creating a new cable and broadband Internet powerhouse.

AT&T said it is offering $95 per DirecTV share in a combination of stock and cash, a 10 percent premium over Friday’s closing price of $86.18. The cash portion, $28.50 per share, will be financed by cash, asset sales, financing already lined up and other “opportunistic debt market transactions.”

AT&T said it expects the takeover to deliver cost savings at an annual rate of $1.6 billion by the third year after closing. The transaction has a total value of $67.1 billion, including DirecTV’s net debt.

AP

Mentioned In This Post:

About the author

Related Posts

-

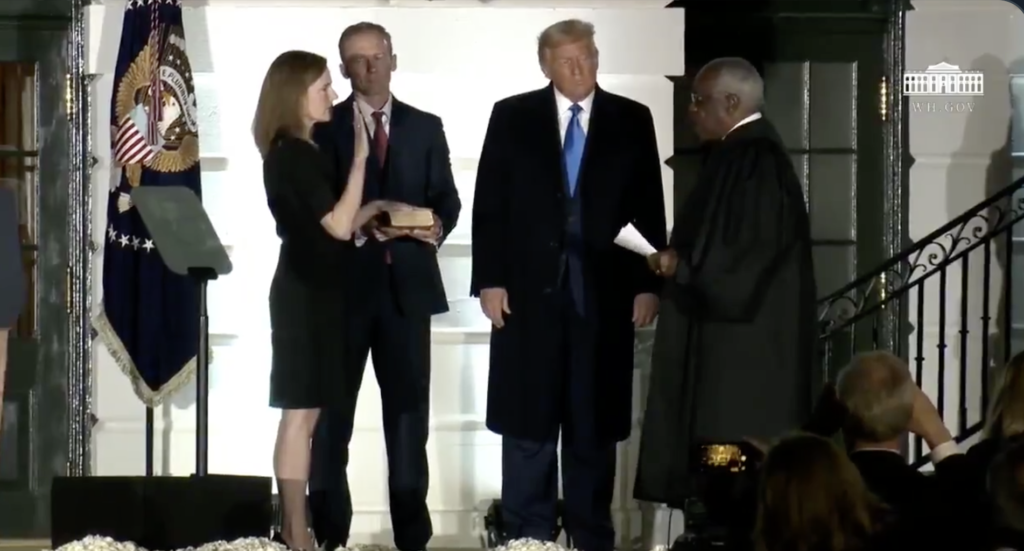

Like it or Not, Amy's In.

-

If Only We All Had Rich Daddies

-

The People Have Had Enough #EndSARS

-

WHAT is Rudy (Trump's Lawyer) Doing Here???

-

Trump Administration Is Coming For Google

-

Terrorist Plot To Kidnap Governor Whitmer

-

Another Day, Another Unarmed Man Killed By Police

-

"Don't Be Afraid of COVID!" He Says

-

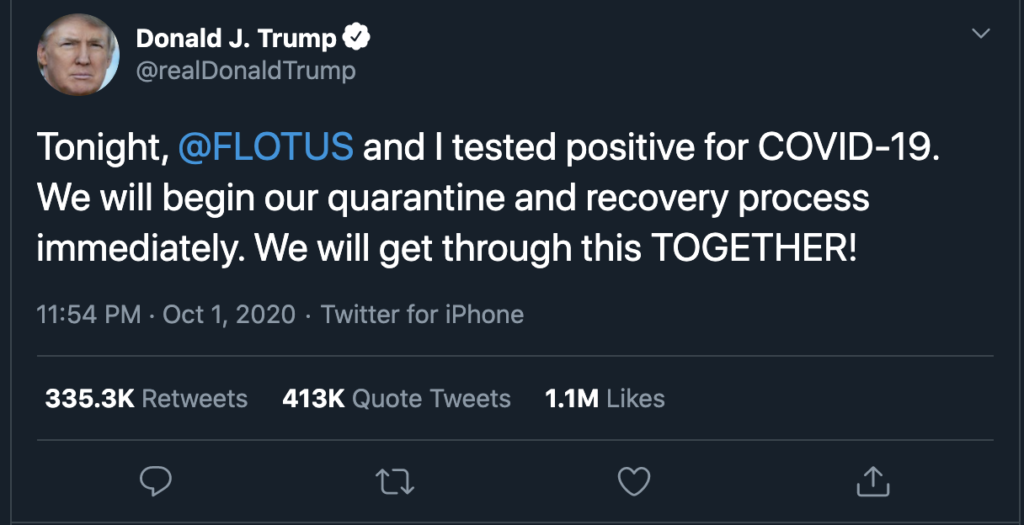

Trumps In The Hospital and His Cronies Are Infected

-

Trump Tests Positive for the 'China Virus'